View the DRAFT 2025-2029 Budget & Five Year Financial Plan

View the DRAFT Financial Plan 2025-2029 Bylaw No. 2847

View the Public Consultation Notice

Frequently Asked Questions PDF

Updated April 22, 2025

The City of Rossland appreciates the feedback we’ve received on the draft 2025-2029 Five-Year Financial Plan Bylaw. Below are responses to common questions and concerns Council is hearing from the community. This page will be updated on an ongoing basis.

The Financial Plan must be adopted prior to May 15 of each year. Council must undertake a process of public consultation regarding the proposed financial plan before it is adopted. The budget consultation period will continue through until May 5th, 2025 (please note that Council has extended the consultation period from April 22nd, 2025, to May 5th based on community feedback).

How to provide your input:

In-Person: a public consultation opportunity will be held on May 5, 2025 at 4:00 p.m. at the City of Rossland Council Chambers

Email: written submissions, comments or questions can be emailed to cfo@rossland.ca

Mail: comments can be submitted via mail to Rossland City Hall, PO Box 1179, Rossland BC, V0G 1Y0

Drop-off: submissions can be dropped off via the drop box at the front doors of City Hall located at 1920 Third Avenue or at the front desk during regular business hours (9:00 a.m. to 4:00 p.m. Monday to Friday).

*Written submissions must be submitted no later than April 30, 2025.

We also encourage you to sign up for the City’s electronic newsletter. To do so, head on over to www.rossland.ca and scroll to the bottom of our home page.

Frequently Asked Questions: 2025-2029 Financial Plan

No.

Only the 2025 tax increase would be confirmed as part of the 2025-2029 Five-Year Financial Plan process.

Every year, the City is legally required to adopt a Five-Year Financial Plan under the Community Charter. This plan includes projections for future years (2026–2029), but those figures are not locked in. They are forecasts, intended to show what might be needed based on current information—not final decisions.

Each year, Council reviews and updates the current year budget using the most up-to-date data on inflation, growth, grant funding, infrastructure needs, and public input.

That said, Council wants to be transparent about the scale of the financial challenges facing the City. Decades of underinvestment in core infrastructure mean that further deferrals risk increasing long-term costs and service disruptions. The projections in this plan are meant to signal the difficult but necessary conversations ahead as we work to maintain and modernize essential services.

Property taxes at the household level are determined based on the assessed value of a home (as determined by BC Assessment Authority). The average value of a residential home in Rossland for 2025 was $616,000. With taxes projected to increase by 10% in 2025 (5% to fund inflationary pressures and 5% to address the City’s infrastructure deficit), the following table illustrates what projected taxes will look like for the average ratepayer from 2025-2029:

If 10% increases were applied in each of the next five years, the cumulative impact would be a 61% increase in Rossland-specific taxes—totaling approximately $4,291 in additional Rossland specific taxes on a home assessed at $616,000 in 2025.

Rossland’s municipal taxes typically account for just over half of the total tax bill residents receive. The remainder comes from other taxing authorities, including the Regional District of Kootenay Boundary (RDKB), the West Kootenay Boundary Regional Hospital District, and the Province of British Columbia (which levies taxes for services like policing and education).

While the City is responsible for collecting these taxes on behalf of these bodies, it has no direct control over the amounts they set. This makes it difficult to provide a final tax estimate for residents until all requisitions have been received.

That said, for 2025, City staff have provided Council with more detailed projections than ever before on expected increases from these external entities, to help inform the overall financial picture and support transparent decision-making.

Some residents have expressed concern that the proposed tax increases have caught them off guard. The Plan builds on direction from Council received by staff on multiple occasions at meetings open to the public:

- October 7th, 2024 Regular Meeting of Council: 2025-2029 Five-Year Financial Plan Preview

- November 4th, 2024 Regular Meeting of Council: 2025-2029 Five-Year Financial Plan Capital Plan Overview

- February 3rd, 2025 Committee of the Whole Meeting: 2025-2029 Five-Year Financial Discussion

Broadly, the budget is built on years of work to quantify and proactively address the City’s infrastructure deficit stemming from the creation of an Asset Management Investment Plan in 2016. The capital expenditures portion of the budget is the most detailed the City has ever created.

Cuts to departments would result in noticeable reductions in service levels, including areas such as snow removal, road maintenance, recreation services and public safety.

While there are some major studies underway in 2025 to provide greater detail on major infrastructure needs, the projects outlined in the capital expenditures section 2025-2029 Five-Year Financial Plan are informed by estimates from engineering studies, contractor reports, internal staff estimates and making minimum acceptable investments in asset management.

Future capital budgets are informed by engineering studies, contractor reports, internal asset condition assessments, and staff estimates. While projections are always subject to refinement, they reflect the best available information at the time of budgeting and are a key part of responsible long-term planning.

Rossland previously had a DCC bylaw, but it was repealed by Council in 2012 as part of an effort to encourage development during a period of slower growth.

DCCs are a specific form of infrastructure funding that must directly or indirectly serve new development. They are not intended to cover the cost of maintaining or replacing aging infrastructure that already serves the community.

To implement DCCs, a municipality must adopt a DCC bylaw that meets several key requirements under the Local Government Act. First, the bylaw must clearly identify the anticipated development in the community and outline the corresponding infrastructure needs. The charges set out in the bylaw must be proportional to the benefit that new development receives from the planned infrastructure improvements.

Second, the process must include consultation with key stakeholders. This includes engagement with the development industry, the general public, and any other affected parties to ensure transparency and fairness in the development of the bylaw.

Third, the proposed bylaw must be submitted to the Inspector of Municipalities at the Ministry of Municipal Affairs for review and approval. This provincial oversight ensures that the bylaw complies with legislative requirements and is based on sound planning principles.

Finally, the bylaw must be supported by a detailed technical report. This report must include growth projections, a list of infrastructure projects that are intended to support new development, cost estimates for each project, a breakdown of how project benefits are shared between new and existing users, and the resulting DCC rate calculations.

As such, most of the infrastructure projects identified in Rossland’s current capital plan—including the bulk of the $53M infrastructure deficit—would not qualify for DCC funding, as they relate to aging infrastructure serving “Old Town”. Replacing an aging sewer main running along Thompson Avenue or repaving a stretch of St. Paul Avenue would not qualify. These are considered part of the City’s responsibility to maintain existing infrastructure.

It is also important to note that some projects identified in the City’s previous DCC bylaw (stemming back to 2005) still haven’t been completed, underscoring the need for careful alignment between funding tools, development growth and implementation capacity.

There are two major steps underway, identified in the 2025 budget, that will help advance the exploration of DCCs and ACCs:

- The completion of the City’s Utilities Master Plan, expected in Q3 2025 (fully funded through a grant from the Union of BC Municipalities), which will outline infrastructure projects which may be suitable for DCCs; and,

- A $100,000 provision to carry out a DCC & ACC report (fully funded through a grant from the Province of BC).

These reports will help determine where and how DCCs might be reintroduced effectively in the context of modern development pressures.

Yes.

The proposed plan includes:

- A study on Development Cost Charges (DCCs) and Amenity Cost Charges (ACCs) is budgeted for 2025, funded by a grant from the province. This will explore projects identified as priorities in the Utilities Master Plan that might qualify for DCCs.

- The City is also revisiting grant strategies and reviewing how it supports community groups.

- Strategic use of debt in 2026, 2027, and 2029, staying within provincial debt servicing limits.

Historically, Rossland has followed a conservative approach that excludes unconfirmed development from revenue forecasts. That said, growth at Redstone and Red Mountain is expected to increase future tax revenues, and updated forecasts are being developed as applications progress through the approval process.

The City has been a leader in regional collaboration with neighbouring communities, sharing services in areas like bylaw enforcement, finance, and recreation on a cost recovery basis. Council and Staff regularly meet with local and regional governments to explore opportunities for collaboration to achieve cost effectiveness, such as through joint approaches to procurement.

The only recent staff addition, which was budgeted for previously, is a Chief Utility Officer, focused on public safety, water system maintenance and improvements.

There are no new hires budgeted for 2026–2029.

AThe City’s decision to sign on to the TRP in 2024 was the product of many years of resident demand for access to affordable recreation services and something that came up frequently during public engagement related to the City’s most recent Recreation Master Plan.

The TRP contract includes a cancellation clause, but doing so would reduce recreation access for residents.

Council acknowledges the tension between rising costs and housing affordability. Infrastructure renewal is essential to maintaining livability and avoiding costlier repairs later.

The City is actively pursuing several strategies to reduce tax increases in future years; including but not limited to:

- Ongoing pursuit of available grant opportunities for everything from infrastructure to recreation, building on a highly successful track record relative to similar size communities;

- A review of current levels of support to community groups across funding channels provided via the City such as Grant In Aid, Permissive Tax Exemptions, Grants In Kind, and other operational and capital support provided via the City’s budget; and,

- A study on opportunities to apply Development Cost Charges and Amenity Cost Charges.

One of the priorities outlined in the City’s Recreation Master Plan and Accessibility Plan was to increase accessibility of recreation amenities.

This project is 100% grant funded!

Huge thanks to our many funders.

These figures help inform capital planning decisions that will be required to ensure sustainable service delivery for the City. They provide context for planning and funding decisions. The actual five-year capital plan totals $51M, many of which are contingent on grant funding, including $4.3M related to complete works on the Greenlink Trail in 2027-2028.

The City owns several properties in Rossland that are underused, including the block south of Rossland Yards on Third Avenue and Spokane Street and Old City Hall on Columbia Avenue. With a finite number of developable sites near the downtown area, Council does not wish to sell strategic properties at a discount simply to generate short-term revenue. These properties are being carefully considered for future use in a way that is best aligned with addressing community needs.

The 2025 budget contains a provision to carry out additional research and feasibility study on strategic use of City-owned properties.

The low proportion of the City’s property tax revenue coming from commercial and business properties has long placed undue burden on taxation of residential properties. While it is not a core function of the City, Rossland supports economic development in several ways:

- Direct annual funding to Chamber of Commerce & Tourism Rossland to help promote local businesses and attract visitors.

- Through the Regional District of Kootenay Boundary (RDKB), the City contributes to organizations such as the Lower Columbia Initiatives Corporation (LCIC), which supports business attraction, investment, and entrepreneurship across the region.

- A variety of social and economic initiatives, including community programming and support services, are funded through the City’s Grant-in-Aid program.

- Through the Economic Development Task Force, which is part of the City’s Sustainability Commission, a group of dedicated volunteers is currently focused on addressing childcare needs—an essential foundation for workforce participation and small business viability.

We know Rossland is a wonderful place to work, live and play, and we welcome help in spreading the word to attract more businesses to our community.

We are not!

The City last granted a Revitalization Tax Exemption in 2019 and has since put a moratorium on considering any future applications.

Exemptions granted in 2019 via Bylaw No. 2682 to Barrie Industries, 9923098 Canada Ltd Inc., Davies Sales and Services Ltd., and Red Mountain Hostel (CBT) Holdings Ltd have now all expired.

The Josie (via WCH Holdings Ltd and Texas Point Holdings) had a revitalization tax exemption from 2016 – 2020 (exempting them from all municipal taxes) when it was under construction. This exemption has since expired.

- Since this exemption, The Josie has paid over $360K in municipal taxes and continues to be the most taxed folio in Rossland ($93K+ in 2024). They will pay over $100K in taxes in 2025.

- Rossland is highly reliant on a residential tax base for municipal property taxes (historically, about 87%). In 2024, the City generated $6.2M in total tax revenue, of which $574K (~9%) came from business.

It is….

……but not enough to address the significant infrastructure deficit that pre-dates much of the development at the resort.

Preliminary projections show that the collective units of the Crescent will generate approximately $175K/ year from 2025 onward. This is factored into rate calculations in the Draft 2025-2029 Five Year Financial Plan.

As we know, Rossland is highly reliant on a residential tax base for municipal property taxes (historically, about 87%). In 2024, the City generated $6.2M in total tax revenue, of which $574K (~9%) came from business.

There is a notable 24% increase year over year in cost associated with RDKB services, of which ~70% relates to anticipated heightened costs associated with construction of the new Columbia Pollution Control Centre (CPCC) in Trail.

The cost of this $75M new sewer treatment facility will be shared proportionally by Rossland, Trail, Warfield and parts of Area B. Though the total capital cost of this project was originally budgeted at $63M+; however, construction inflation since COVID has ballooned.

Rossland established a reserve account to smooth some of the increases; whereas Trail and Warfield will pass the cost along directly to ratepayers all in year one. We have known about this cost increase for 10+ years and have been proactively preparing as best we can to ease the pressure on ratepayers.

Great question!

Even when a project is 100% covered by grant funding, we’re still required by law to show the full cost in our budget. Under the Community Charter (the legislation that governs how BC municipalities operate), the budget—and the bylaw that goes with it—gives Council the legal authority to spend money.

That means all expenses, including grant-funded ones, must be included so Council can formally approve them. It doesn’t mean we’re using local tax dollars for those projects—it just checks the required legal box to be able to take the projects on.

Are Red Mountain and Redstone paying their fair share of taxes?

Simply put, yes…. and their proportion of taxation is growing.

-

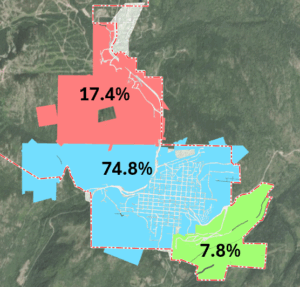

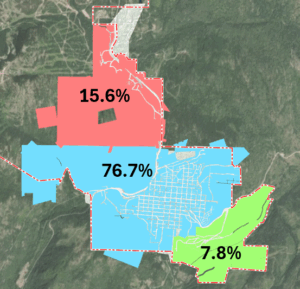

In 2024, the Red Mountain zone of Rossland generated 17.4% of all municipal taxes, compared to 74.8% in Old Town and 7.8% in Redstone.

- In 2024, the proportionate BC Assessment values of these properties were 15.6% of Rossland’s total assessment value for Red Mountain, compared to 76.7% in Old Town and 7.8% in Redstone.

-

The total number of folios in 2024 was Red Mountain 467 (18.8%), Old Town 1843 (74.3%), Redstone 170 (6.9%)

-

Based on assessment value versus taxes paid, Red Mountain paid proportionally more than their share compared to other locations in Rossland. This is primarily due to the make-up of the taxable properties in the Red Mountain zone – a higher concentration of business properties leads to a higher tax burden on the area.

-

Whenever a new development is created, developers are required to either provide or pay for any infrastructure required to tie into existing City infrastructure (including developments of new subdivisions). In 2024, development contributed $2.5M in assets to the City, all of which came from Red Mountain.

-

Since 2009, developers have contributed $7.3M in assets to the City, with the majority of this in the Red Mountain and Redstone zones.

-

With the over a hundred units coming online at Red Mountain for the 2025 tax year (including 104 at the Crescent), the proportionate share of taxes is projected to be Red Mountain 19.3%, Old Town 73%, and Redstone 7.6%