Property Taxes

Property owners in Rossland are required to pay taxes based on the value of their property. Property taxes are levied and collected by the City of Rossland. The City is also responsible for the collection and distribution of taxes for the Province (school taxes), Regional District, Regional Hospital, BC Assessment and Municipal Finance Authority. The City uses tax revenue to support municipal services, projects, and infrastructure – which helps maintain Rossland’s high quality of life. The City also provides water, sewer, and garbage collection services for residents and business owners in Rossland.

Property Tax Due Date: Wednesday, July 2nd, 2025 by 4:00 p.m. PST

Property Tax Payments and Home Owner Grants must be received on or before WEDNESDAY, July 2nd, 2025 at 4:00 p.m.

A 10% penalty will be applied to all unpaid taxes including unclaimed Home Owner Grants (HOG). The penalty is a provincially legislated requirement and cannot be reversed for any reason, including not receiving your Tax Notice.

Municipal Services During a Potential Canada Post Work Disruption – click here for guidance.

Home Owner Grant

All home owners in BC now must apply for the grant directly through the Province. For more information on claiming your Home Owner Grant in 2025, please click here. The process is very simple, takes only a few moments, and could save you hundreds of dollars on your property taxes!

Property Tax Deferment

Tax deferment is a low interest loan program that helps qualified B.C. homeowners pay their annual property taxes on their principal residence. Essentially, it allows qualified homeowners to delay when they pay their taxes, reducing the financial burden to pay property taxes in the short term.

You may qualify if you are 55 years of age or older, a surviving spouse or a disabled person as defined by regulation or, financially supporting a dependent child under the age of 18. For details see the Provincial Government website.

Please use the website to use the eligibility calculators to pre-qualify and get access to the application. Applications are not available until late May. The property tax deferment program application process has moved to an ONLINE delivery system for new applications and renewals. Paper applications can only be obtained by calling the Province of BC at 1-888-355-2700.

Payment Options

City Hall

Payments can be made at City Hall with cash, cheque, or debit card. Credit card payments are accepted at City Hall via self-serve kiosk or online.

Drop Box

The mail slot is located at the entrance to City Hall at 1920 Third Ave. Please write your tax roll number on your cheque payable to City of Rossland. Cheques can be postdated for July 2, 2025.

By Mail

Please make cheques payable to the City of Rossland. Remember to include the roll number with your cheque payment. Post-dated cheques are accepted, however, returned or NSF cheques will be treated as non-payment and subject to all applicable penalties and a $25 service charge. Please allow for sufficient time for delivery. Post-marks will not be accepted as date of payment.

Online Banking

Property taxes can be paid through most financial institutions. Your account number is your 11 digit Roll # (do not include the period, dot or spaces) and do not use your Utility account. A $5.00 fee is charged for transfers between accounts. Please note that you CANNOT claim the Homeowner Grant at your Financial Institution.

Mortgage Company

If your mortgage company pays your property taxes, it is your responsibility to claim the Home Owner grant by WEDNESDAY, July 2, 2025. Please ensure that your mortgage provider is aware you are claiming the Home Owner Grant (if applicable). The City of Rossland is not responsible for errors made by mortgage providers.

Pre-Payment Plan

If you are already on the Pre-Payment Plan, it is your responsibility to pay any remaining balance. Your Prepayment Plan will continue with the same amount in July 2025, unless you notify the City.

Not on the Plan? Sign up to pay your 2026 taxes in 11 equal monthly payments commencing in July 2025 and ending in May 2026 for the amount that you choose. Your account must be paid in full for the current year to qualify. The balance due or credit will show on your Tax Notice in the following year. Property Tax Pre-Authorized Payment Application Form.

Credit Card

Credit Card payments can be made in person at City Hall, with a Convenience Fee of 2.75%, or made online with a Convenience Fee of 2.50%.

Online Services

Here you can check your Property Tax balance and choose to receive future tax notices by email. Link your Utility and Property Tax accounts and never have to ask for a reprint of your tax or utility bill again. Sign up or Log in.

Are you signed up to receive your bill electronically? Did you get a black or blank screen? Click here for more information

How to sign up for e-billing:

- Create an online account to view and manage your property tax and utility information all in one place.

- To set up and access your property tax account online, you will need:

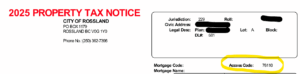

- Your Roll Number

- The Access Code/PIN from a recent property tax bill

- Visit Rossland Online Services

- Select the “Not Registered – Sign Up” button

- Select “Show Me How”

- Select Account Type: PT-Property Tax

- Fill in your Roll Number and Access Code

- Select “Please Notify me by Email That my Property Tax Notice is Ready”

- And select “Attach a PDF Copy of the Property Tax Notice to the Email.

- Enter your Email Address and select “Send Verification Email”

- Check your email account for an email from noreply@rossland.ca (don’t forget to check your Junk Mail folder!).

- Copy the verification code from your email to the registration page.

- Create your User Name and Password, select “Send Verification Email”

- Copy the verification code from your email to the registration page and select Save.

We recommend using the Chrome web browser to manage your accounts. This service does not work with Internet Explorer. You will need to enter the last 8 digits of your 11 digit roll number and your property tax access code. Both numbers can be found on the front of your Property Tax Notice in the top right corner.

| For example: Roll number as it appears on your property tax notice | 229 XXXXX.XXX |

|---|---|

| Five-digit access code on the front of the notice | XXXXX |

Online Payments Through Your Bank

Please ensure your online payment details are correct!

Bill Payee: “Rossland, City – Property Tax” (NOT Utilities)

Account #: 11 digit roll number (without spaces or punctuation) that appears at the top right corner of your Property Tax Notice and begins with 229.

Payment must be received in the City of Rossland bank account BEFORE the deadline. Online payments can take up to 5 business days to be processed by your financial institution.